Investment Mangement

As simple as possible, but not simpler

We invite you to learn how and why we approach investing the way we do

About our Investment Philosophy

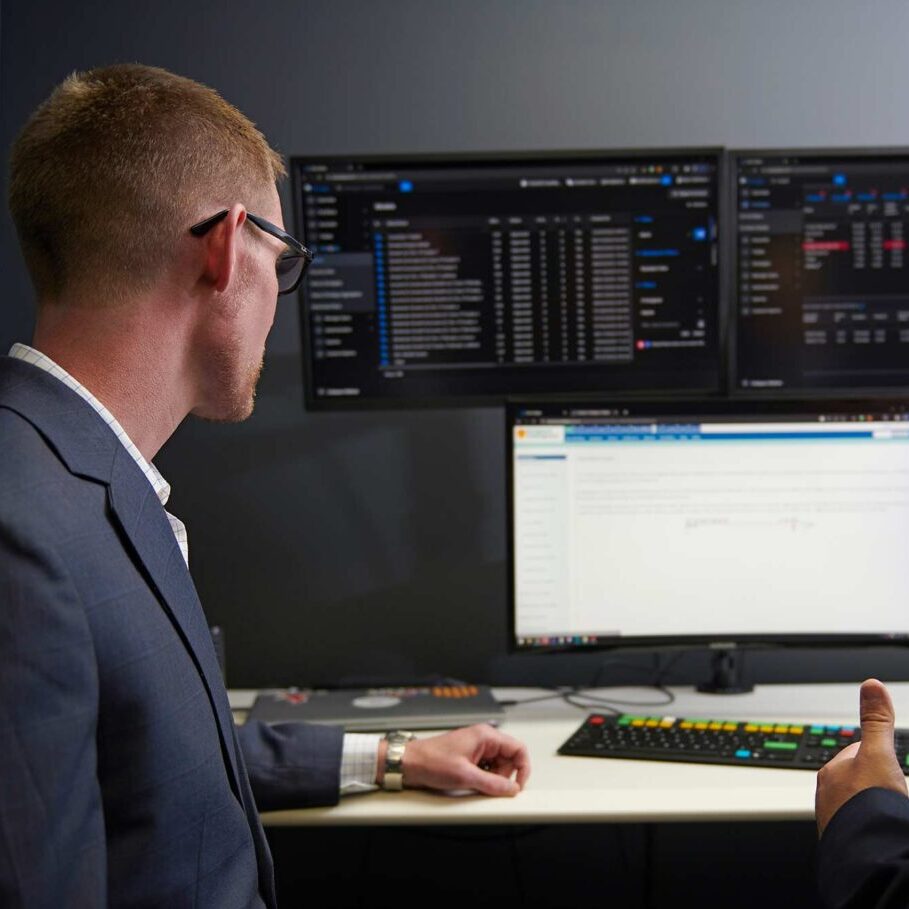

We believe our approach to investment management is more advanced than clients are likely to encounter in most other settings. For example, we avoid generic “risk bucketing” and other shortcuts that can interfere with an investment plan truly attuned to your specific needs.

As market conditions change, we stay true to grounded, long-term objectives while seeking opportunities to improve portfolios mindful of tax efficiency. We are also entirely transparent about our fees and our only source of compensation is from our clients, never any products we utilize.

Our investment philosophy is inspired by Albert Einstein's guidance to “make everything as simple as possible, but not simpler.”

“There’s no dollar sign on a peace of mind, this I’ve come to know.”

-Zac Brown Band